TAX ALERT

POSSIBLE REPEAL OF SECTION §1309 – DEDUCTION FOR ALIMONY PAYMENTS

The recent Tax Reform Bill presented by the House of Representatives includes a provision to eliminate the tax deduction for alimony payments effective January 1, 2018. The alimony deduction will not be available for all divorce decrees, separation agreements and modification orders entered beginning January 1, 2018.

The current law allows the payor to deduct alimony payments from their income and for the payee to report the alimony as income provided the requirements of the Seven (7) D’s[1] are met:

- Dollars – payments must be in dollars and not services.

- Distance – parties do not live together.

- Documents – a written divorce decree, separation agreement or Court order (can include temporary orders); excludes voluntary payments.

- Death – must terminate on the death of the payee.

- Designation – Cannot be for something else.

- Dumping – the alimony payments can’t be front loaded otherwise payor subject to recapture.

- Dependents – Cannot be for child support (also cannot be contingent on child support event).

The proposed new tax bill eliminates these payments as tax deductible effective January 1, 2018.

Potential Impact:

- Consider in any pending cases (agreements or at trial) to offer alimony in the alternative (with tax effect and without) in case the provision becomes law in the next few months as the effective date kicks in very quickly.

- In some cases, agreements are being withheld to allow parties to stay married through the end of the year to take advantage of filing a joint income tax return for 2017. If you have agreements like this on-hold that include an alimony provision, consider revisiting with opposing counsel to enable the parties to benefit from the current tax law.

- Any pending alimony modification cases will also be impacted by this provision if unresolved prior to the end of the year.

- Where interest payments (on equitable distribution payments) are couched as alimony to afford the payor the tax deduction, this option will be eliminated.

- BEST NEWS – If this provision becomes law, there will be no need to consider the recapture rule when determining alimony. There will be no concern about front-loading alimony. Say goodbye to your alimony/recapture calculator.

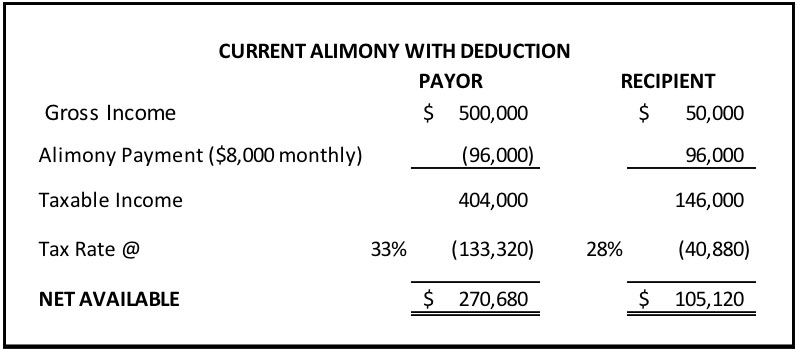

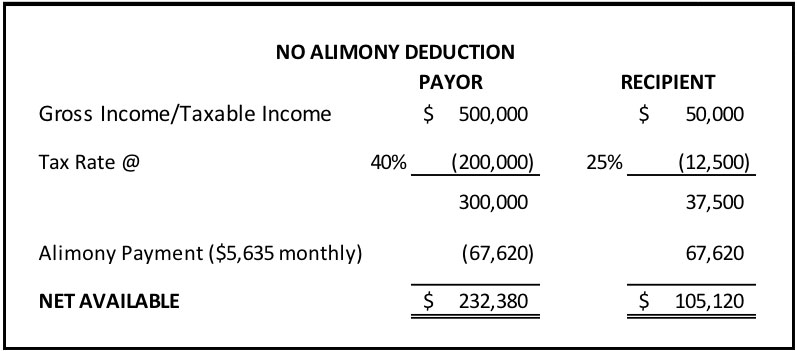

COMPARISON BETWEEN CURRENT ALIMONY LAW AND PROPOSED ALIMONY LAW – EXAMPLES

The following is an example assuming 15% and 40% income tax rates for the Recipient and Payor, respectively.

Assuming the Payor’s income tax rate is constant the increase in Net Alimony Cost attributable to the proposed tax law would be solely based on the Recipient’s tax bracket. There is an inverse relationship between the Payor’s Net Alimony Cost and the Recipient’s income tax rate. As the Recipient’s income tax rate increases the Payor’s Net Alimony Cost decreases. However, the increase in the Net Alimony Cost is also dependent upon the Payor’s income tax rate and there is a reciprocal relationship – the lower the Payor’s income tax rate the lower the increase in the Payor’s Net Alimony Cost.

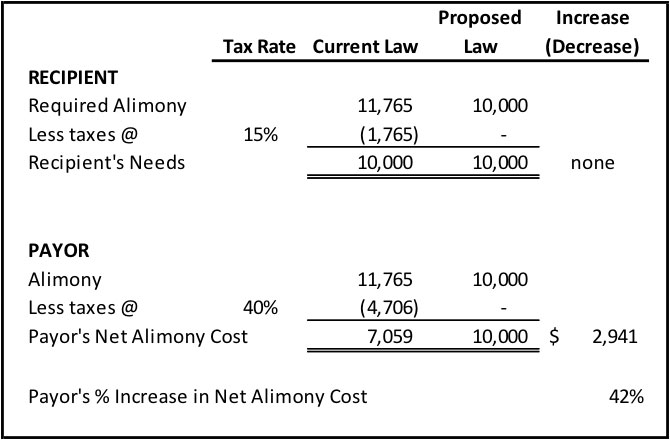

The below example assumes the Recipient’s income tax rate is 20% rather than 15% in the above example. The 5% increase in the Recipient’s income tax rate decreases the Payor’s Net Alimony Cost by $441 ($2,941 less $2,500).

It is important to note the recent Tax Reform Bill presented by the House of Representatives is subject to change and the legislation may not even pass in the Senate. However, please keep an eye on this provision as the effective date, as currently proposed, is just a few months away!

By: Natalie Lemos, Esq., Leinoff & Lemos, P.A.

James Reto, CPA, Kaufman Rossin & Co. PA

[1] The Seven D’s were coined by the late Melvin Frumkes, a former Fellow and tax expert.